california sales tax payment plan

Effective April 2 2020 small businesses with less than 5 million in taxable annual sales. Breaking news about California offering 12-month sales tax payment plans to small businesses impacted by the COVID-19 pandemic.

California Tax Payment Plan Get California Tax Help Today

A Sellers Permit is issued to business owners and allows them to.

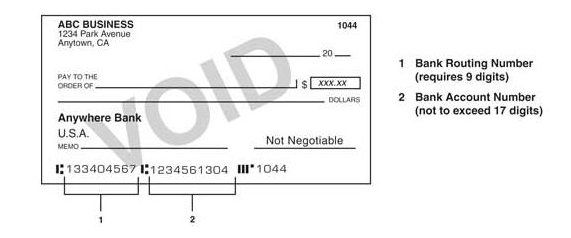

. Box 2952 Sacramento CA 95812-2952. Pay by automatic withdrawal from my bank account. Ad Register and Subscribe Now to work on your CA Sales Use Tax Rates more fillable forms.

To change your current installment agreement call us at 800 689-4776. For the approximate 995 of business taxpayers. California Announces Sales Tax Payment Plan for Small Businesses BREAKING NEWS Effective April 2 2020 California is granting small businesses 12 months to gradually.

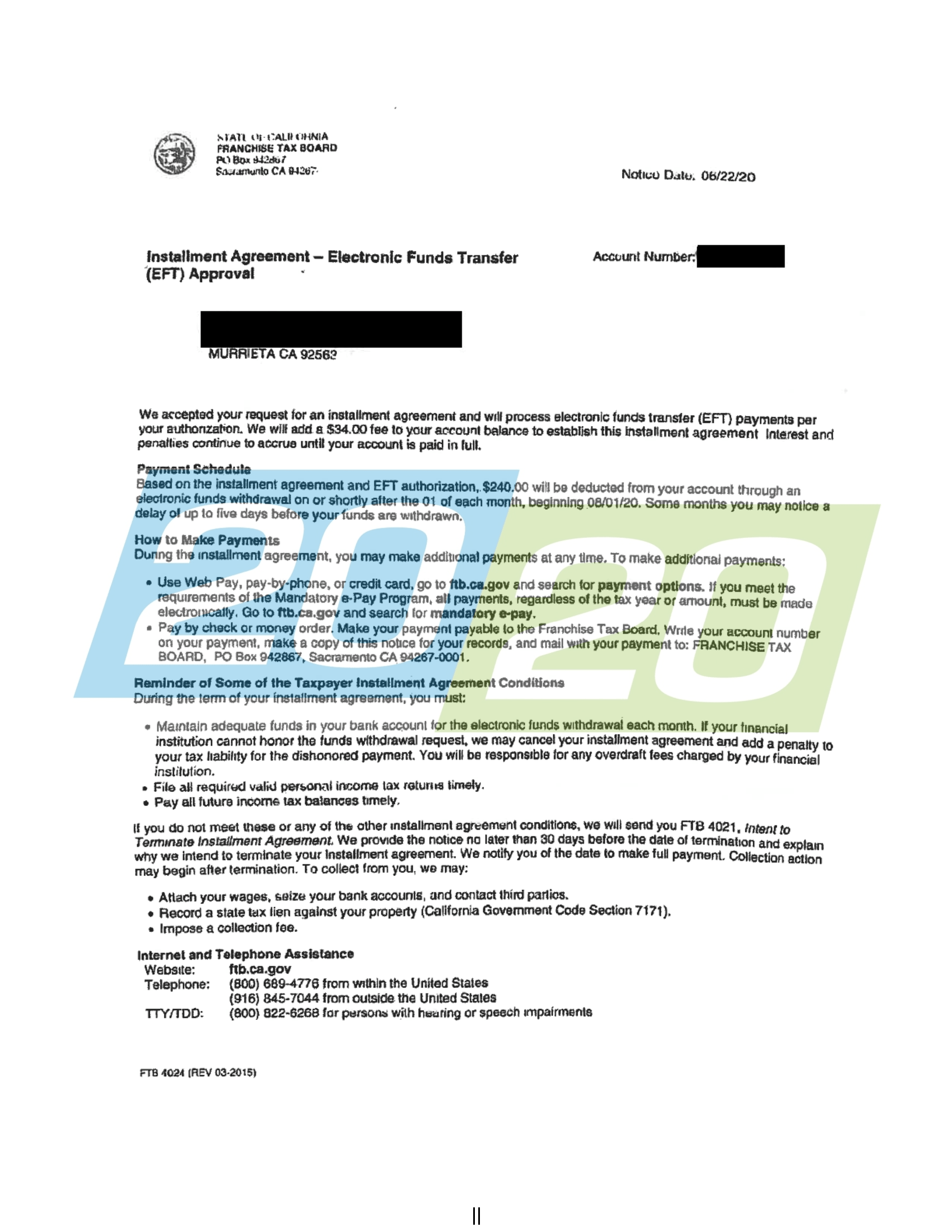

An application fee of 34 will be. Pay a 34 setup fee that will be added to my balance due. Common reasons to change or cancel.

Simplified income payroll sales and use tax information for you and your business. You can register online for most sales and use tax accounts and special tax and fee programs. For help with determining how to respond to.

For sales and use tax originally due between December 15 2020 and April 30 2021 business taxpayers with less than 5 million in annual taxable sales are eligible for a 12. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Effective December 15 2020 small business taxpayers with less than 5 million in taxable annual sales can take advantage of a 12-month interest-free payment plan for up to 50000 of sales.

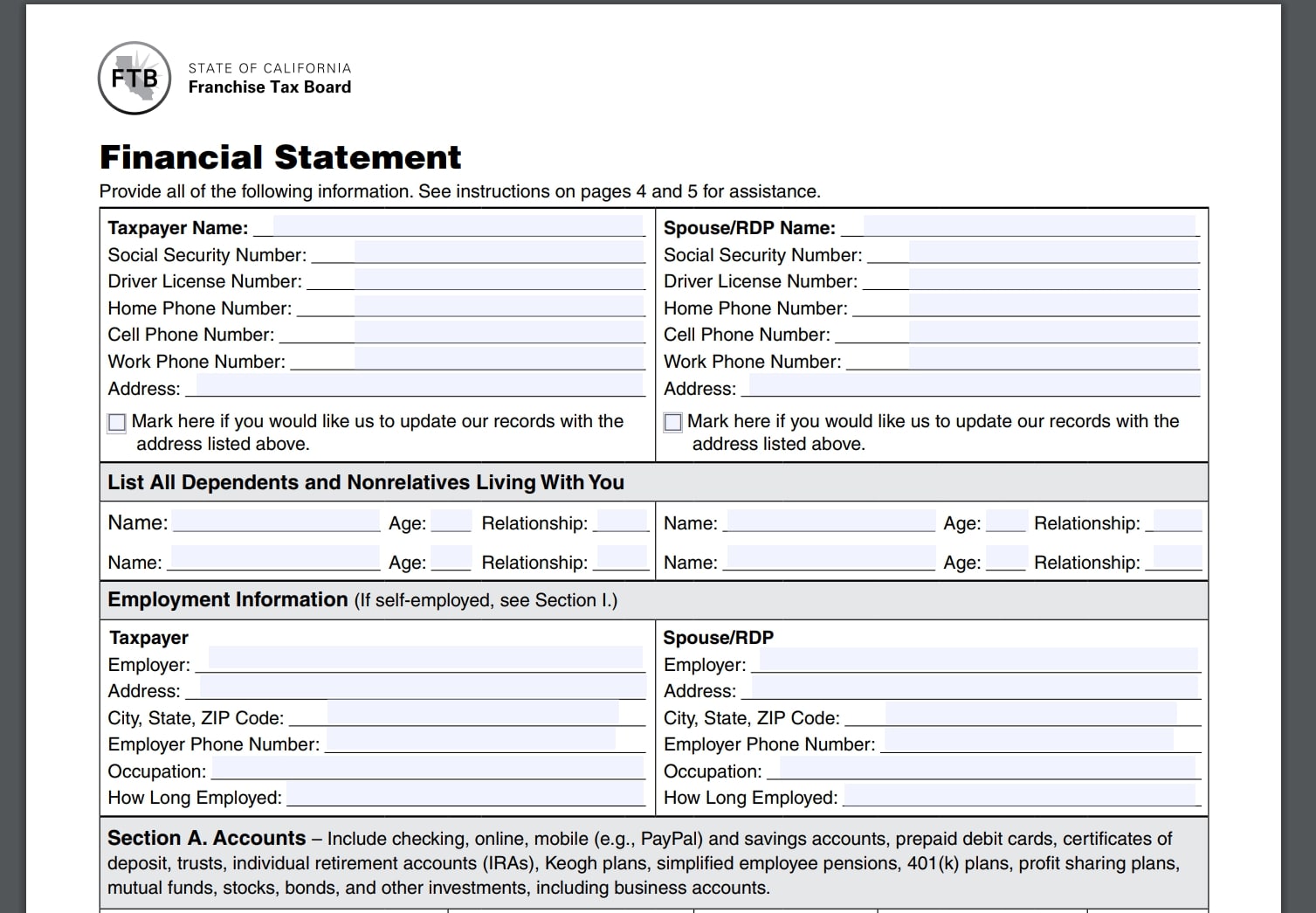

Businesses with a monthly or quarterly. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. Interactive Tax Map Unlimited Use.

Please visit our State of Emergency Tax Relief page for additional information. Ad Ca Taxes California Tax Same Day. California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19.

Under the Payments section select Request a Payment Plan to begin your request. Change or cancel a payment plan. Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax.

Make monthly payments until my tax bill is paid in full. Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax. Please visit our State of Emergency Tax Relief page for additional information.

Ad Lookup Sales Tax Rates For Free. Ca Taxes California Tax- Current Update Feb 2022. Providing a three-month extension for a tax return or payment to any businesses filing a return for less than 1 million in tax.

It may take up to 60 days to process your request. Change your payment amount or. State Local and District Sales and Use Tax Return CDTFA-401 PDF General Resale Certificate CDTFA-230 PDF.

Processing the application takes 90 days and costs 34 for individuals and 50 for businesses. California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19. Individual taxpayers and businesses can apply for instalment plan agreements from the FTB.

Effective April 2 2020 qualified small businesses can take advantage of a sales tax. Businesses with a monthly sales and use tax payment due March 20 2020 will now have until May 20 2020 to make that payment. A Sellers Permit is issued to business owners and allows them to.

Keep enough money in. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

Stop Wage Garnishments From The California Franchise Tax Board Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

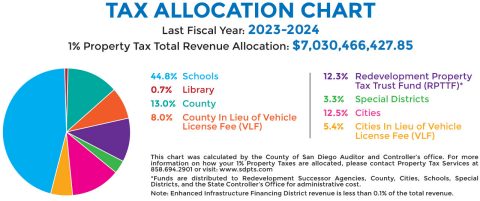

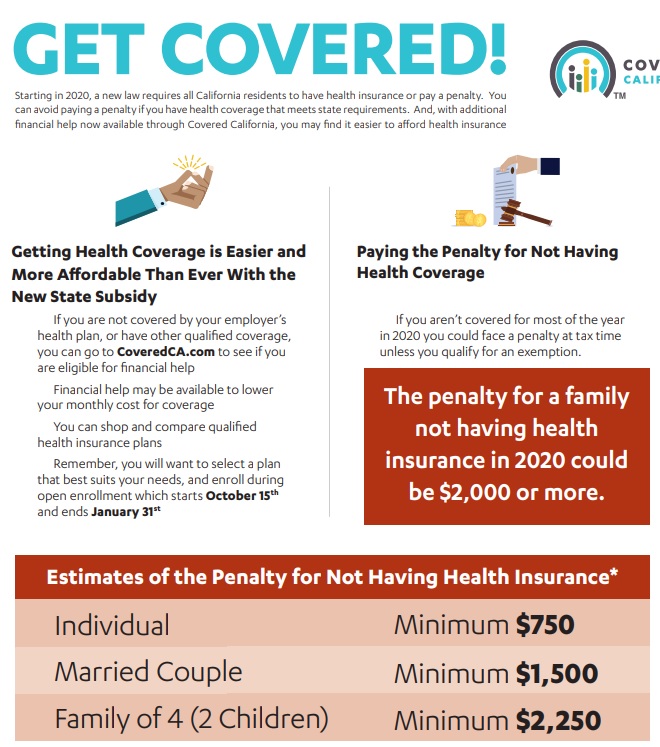

Mandate Individual Shared Responsibility Isr Penalty California

California Sales Tax Small Business Guide Truic

California Sees Warning Sign From Weak Tax Revenue Collections Bloomberg

Ca Homeowners Here S How The Gop Tax Plan Might Affect You Kpcc Npr News For Southern California 89 3 Fm

2022 State Tax Reform State Tax Relief Rebate Checks

State Accepts Payment Plan In Murrieta Ca 20 20 Tax Resolution

Largest State Tax Hike Ever Was Likely Just A Down Payment For California S Failed Single Payer Health Plan

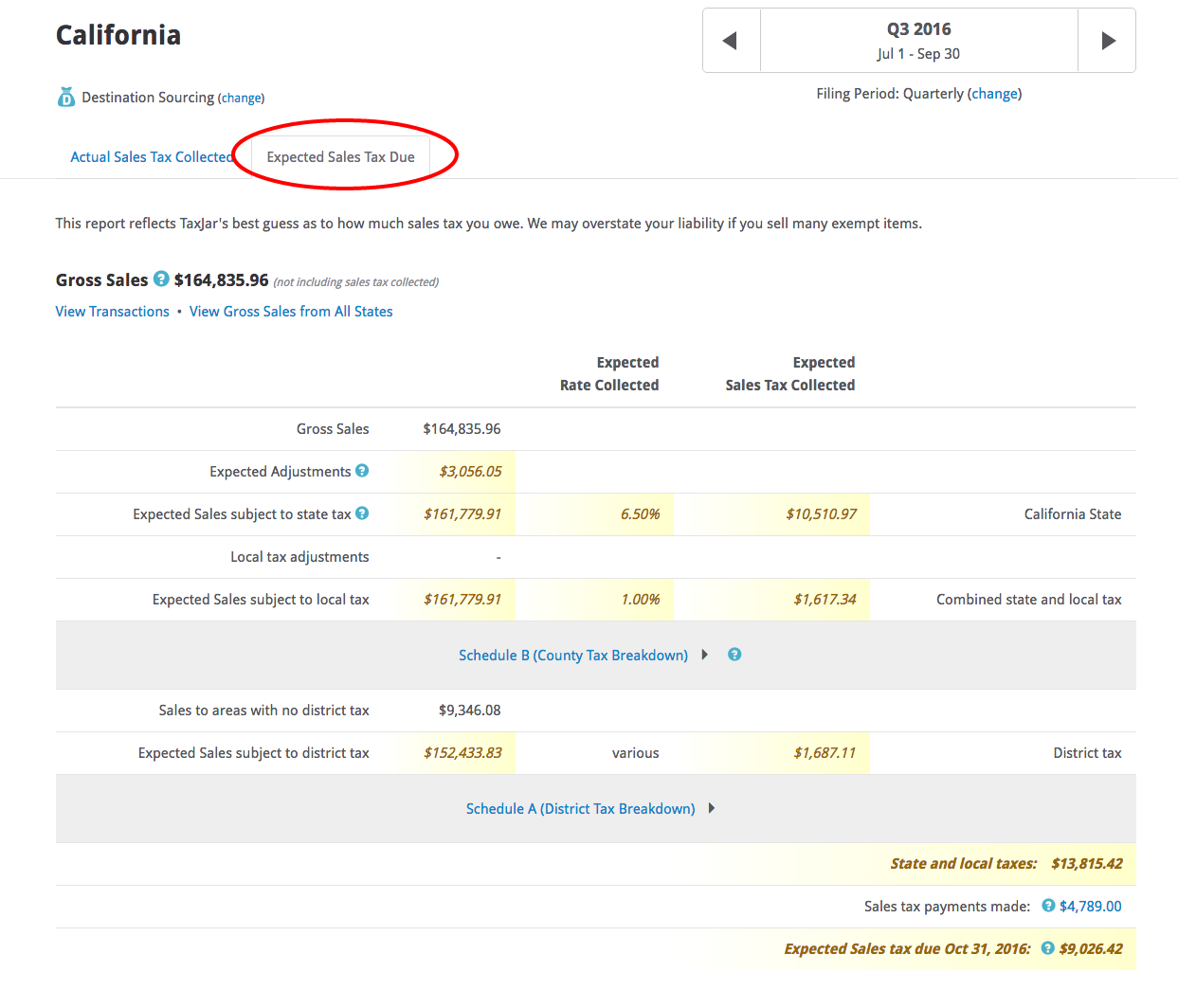

How To Fill Out Schedule B On The California Sales Tax Return Taxjar

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Gov Newsom Unveils Tax Relief Cash Grants For Small Businesses

How To Calculate California Sales Tax 11 Steps With Pictures

How To File And Pay Sales Tax In California Taxvalet

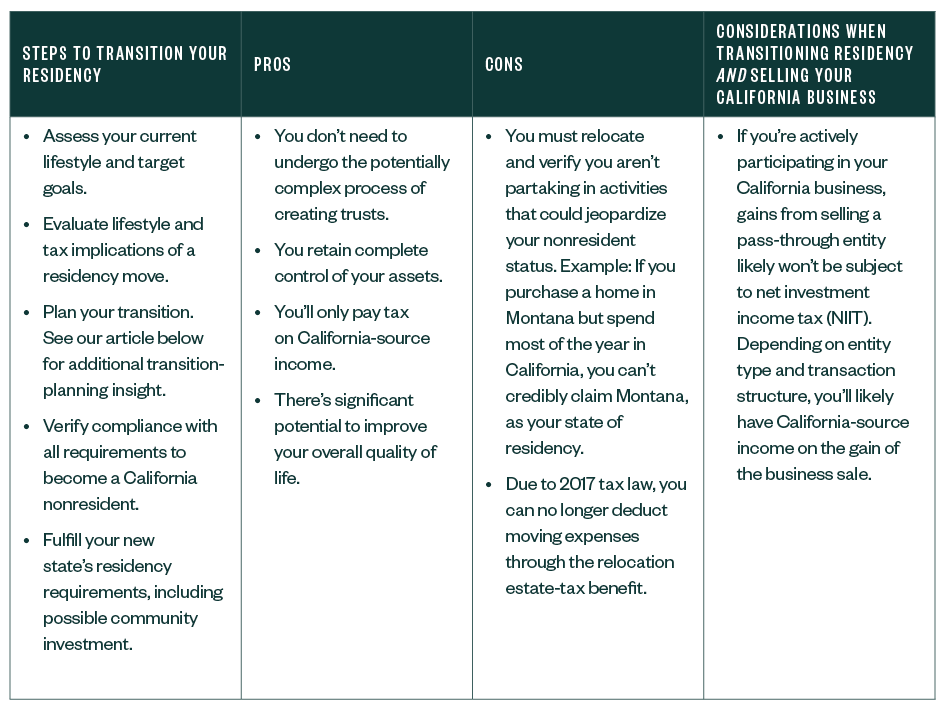

Considerations For Changing Your Residency From California

Online Payments Frequently Asked Questions Faqs

California Estate Tax Everything You Need To Know Smartasset